We Are Currently Hiring!

Welcome to the latest edition of the Healy Wealth Management newsletter, your monthly guide to navigating the financial complexities of life.

Let us know your thoughts. And if there’s something that could benefit a friend or family member, please send it their way.

Click below to watch Kathy and John Healy discuss how we help clients decide on their investment objective in light of the myriad of risks we all face as investors.

I have a head, and I have a tail, but I have no body.

What am I?

Happiness and money have a complex relationship. Money itself doesn’t guarantee happiness, but the way we manage it can either enhance our well-being or become a source of stress. True financial freedom isn’t about accumulating the most wealth—it’s about having control over your financial life, making wise choices, and having the courage to balance prudence with enjoyment.

At its core, financial success is about living in truth. And the truth about money is simple: You can only spend what you have, wealth is built through patience and discipline, and financial security requires both wisdom and courage. But money is also meant to be used—it’s a resource for meeting our needs, bringing joy when spent wisely, and blessing others.

The Truth About Money

The basic math of finance is straightforward. Spend less than you earn. Save diligently. Invest prudently. Avoid unnecessary debt. These principles are timeless, yet many people struggle to follow them. Why?

Because money has a way of pulling us in different directions. It can tempt us to spend recklessly, chase quick profits, or delay financial responsibility for the sake of short-term pleasure.

But the truth about money isn’t just about avoiding excess—it’s also about using it wisely. The person who hoards every penny out of fear is just as out of balance as the one who overspends without a plan. Financial wisdom lies in the middle ground: knowing when to save, when to invest, when to be generous, and when to spend on experiences and things that bring real fulfillment.

Consider the power of delayed gratification. A young professional who consistently saves a portion of their income, even when it means driving an older car or skipping unnecessary luxuries, will later find themselves with financial security. But that doesn’t mean they never enjoy their money. Someone who is financially responsible can still take vacations, enjoy dining out, or buy quality things—because they do so intentionally, within their means, and without sacrificing their long-term well-being.

Courage in Financial Decisions

Knowing what’s right and doing what’s right are two different things. It takes courage to make tough financial choices. It takes courage to live within your means when the world around you is obsessed with consumption. It takes courage to stick to a budget, to invest during uncertain times, and to say no to purchases that don’t align with your goals.

But it also takes courage to enjoy money without guilt. Some people are so focused on saving that they forget money is also meant to be used. It’s okay to spend on things that add value to your life—whether that’s a memorable trip with family, supporting a cause you care about, or even treating yourself to something special. The key is balance.

Courage doesn’t mean we’re never afraid. It means we trust in something greater than ourselves. It means we have confidence—not in our own power, but in the strength given to us to make wise choices, even when they feel difficult.

The Reward of Financial Balance

At the end of the day, money is a tool. It should never control us, but we also shouldn’t be afraid to use it wisely. When we live in alignment with financial truth—when we make choices rooted in wisdom, patience, and discipline—we experience peace. We are not enslaved by debt or financial stress. Instead, we can enjoy the freedom of knowing our needs are met, our future is secure, and our money is working for us.

Financial freedom isn’t just about sacrifice. It’s about making choices that bring both security and joy—spending wisely, saving consistently, and using money in ways that align with your values. When you do that, you’re not just managing money—you’re mastering it.

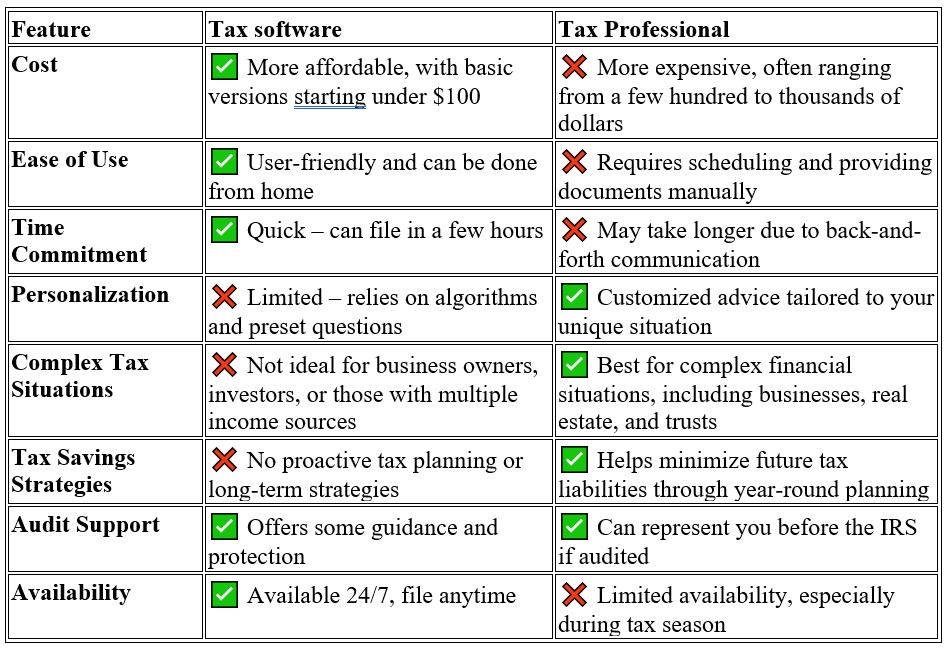

Tax season can be stressful. And deciding whether to use tax software or hire a CPA depends on your financial situation. Here’s a side-by-side comparison of the pros and cons to help you decide:

If your tax situation is simple, tax software is a cost-effective and convenient choice. However, if you have a business, investments, or need tax planning, a CPA may save you more money in the long run.

Need help deciding? Let’s discuss how tax planning fits into your overall financial strategy!

“ ‘I don’t know’ is not an admission of ignorance. It’s an expression of intellectual humility.

‘I was wrong’ is not a confession of failure. It’s a display of intellectual integrity.

‘I don’t understand’ is not a sign of stupidity. It’s a catalyst for intellectual curiosity. “

– Adam Grant

Answer: A Coin