We Are Currently Hiring!

Welcome to the latest edition of the Healy Wealth Management newsletter, your monthly guide to navigating the financial complexities of life.

Let us know your thoughts. And if there’s something that could benefit a friend or family member, please send it their way.

Click below to watch Kathy Healy use a Magic 8 Ball to answer some of the biggest financial questions we’ve been hearing lately. It’s a lighthearted way to explore why guesswork, algorithms, and generic advice will never replace personalized planning. Whether you’re investing after a business sale or considering a Roth conversion, we’re here to give you answers built around you.

I’m never seen but guide your way.

Ignore me and there’s price to pay.

I can’t predict what lies ahead,

But build with me and fear is shed.

What am I?

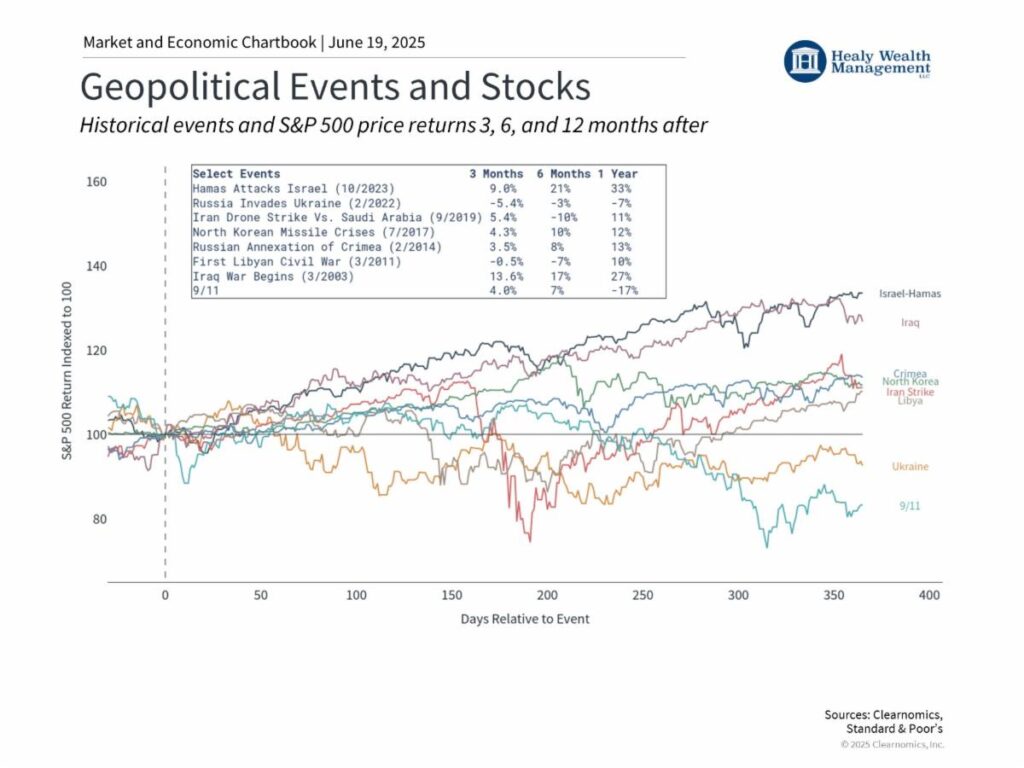

The above chart shows that, while the humanitarian consequences are most important, it’s also necessary for investors to understand how global events impact markets. Perhaps the biggest concern among investors is whether events like these could escalate into full-scale global wars. While this is always possible, recent history does not point in this direction.

Instead, even serious conflicts, including Russia’s invasion of Ukraine and Hamas’s attack on Israel, remained contained, leading only to short-term stock market volatility.

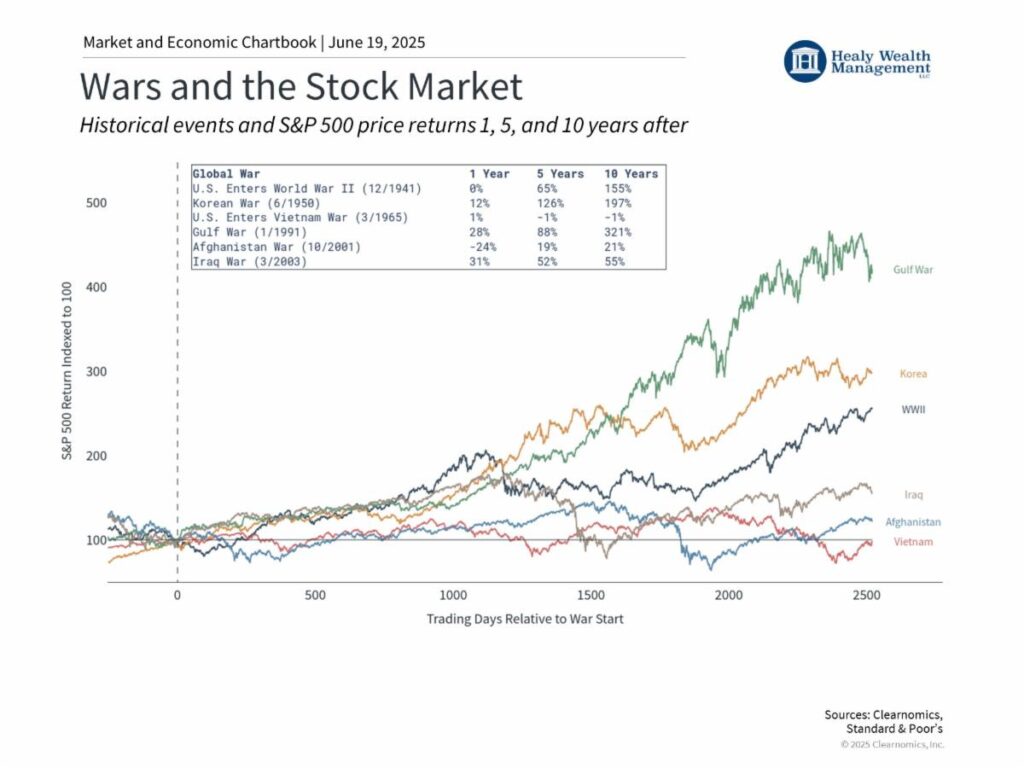

From World War II to the Iraq War, markets may have reacted to these conflicts in the short run, but were driven by investment fundamentals in the long run. For the current situation, much will depend on whether the conflict expands further or begins to de-escalate. The involvement of major powers and threats to critical supply routes add complexity, but history suggests that even significant regional conflicts tend to have limited long-term impact on global financial markets.

Today’s Middle East tensions have created short-term market volatility. Investors should maintain perspective and avoid overreacting to headlines. A portfolio aligned with long-term financial goals remains the best approach for navigating periods of geopolitical uncertainty.

From global flashpoints like Iran and Ukraine to domestic debates over tariffs, deficits, and immigration, it’s easy to get distracted by the headlines. But as investors, our job is not to react to noise. It’s to identify which developments truly alter the long-term economics of the businesses we own. Only then can we rationally decide what action to take – buy, sell, or hold.

Historically, the U.S. balanced open immigration with limited government support. In the early 20th century, millions arrived with little bureaucracy and no expectation of public benefits. But over time, the equation shifted. Programs like Social Security, Medicare, food assistance, and housing support added complexity to immigration policy—not just who is allowed in, but who qualifies for assistance.

Today, unauthorized immigrants are generally excluded from these benefits, and even most legal immigrants must wait five years before qualifying. Still, the perception that immigration burdens public resources has shaped public attitudes and hardened policy. Legal immigration has become more difficult, backlogs are extensive, and enforcement through deportation and detention has intensified. Despite that, the U.S. remains a destination for talent, labor, and entrepreneurship.

Industries like agriculture, construction, logistics, and hospitality rely heavily on immigrant labor. When enforcement rises and legal channels tighten, access to workers shrinks, wages rise, and margins compress. Businesses that depend on low-cost labor and operate with little pricing power are most vulnerable.

This is where our investment philosophy comes into focus. We don’t invest based on political opinions or policy forecasts. We invest based on the underlying economics of a business—its ability to generate durable profits and protect its margins over time. Strong businesses don’t fold under labor pressure. They adjust. They automate, streamline, and—most importantly—raise prices when necessary. They have loyal customers, efficient operations, and structural advantages that allow them to absorb cost increases without damaging long-term returns on capital.

No one can consistently and accurately forecast macroeconomic variables in the short-term, much less the markets. Instead, we operate under the enduring assumption that free markets will persist and that well-managed businesses with competitive advantages will thrive over time. Our focus remains fixed on evaluating companies one by one, assessing their earning power, reinvestment capabilities, and adaptability to challenges—regardless of what’s in the news cycle.

“If all the economists were laid end to end, they’d never reach a conclusion.”

– George Bernard Shaw

Answer: A plan.