We Are Currently Hiring!

Welcome to the latest edition of the Healy Wealth Management newsletter, your monthly guide to navigating the financial complexities of life.

Let us know your thoughts. And if there’s something that could benefit a friend or family member, please send it their way.

In this insightful video, we discuss the unique challenges women face when planning for retirement and offer practical strategies and actionable tips for overcoming them.

Kathy Healy explains why women may need to save more due to a longer life expectancy and highlights how factors like career breaks and the gender pay gap can impact retirement savings.

Kathy also emphasizes the importance of maximizing 401k contributions and Social Security benefits to build a solid foundation for the future.

Let’s work together to create a stronger financial future!

I have branches, but no leaves,

no trunk, and no fruit.

What am I?

Over the past year, Berkshire Hathaway Inc., run by Warren Buffett, aggressively sold 2/3rds of its shares in Apple for approximately $120 billion. After this sale, plus roughly $6 billion in sales of Bank of America stock, plus normal operating cash flows from internal operations, the company’s cash balance has now doubled to $320 billion from $163 billion last year. Cash now represents 32% of the Berkshire Hathaway’s market value.

Despite these sales of Apple, Buffett continues to express strong confidence in Apple’s business and leadership. He said his decision was influenced by tax considerations, noting that the current corporate tax rate is historically low.

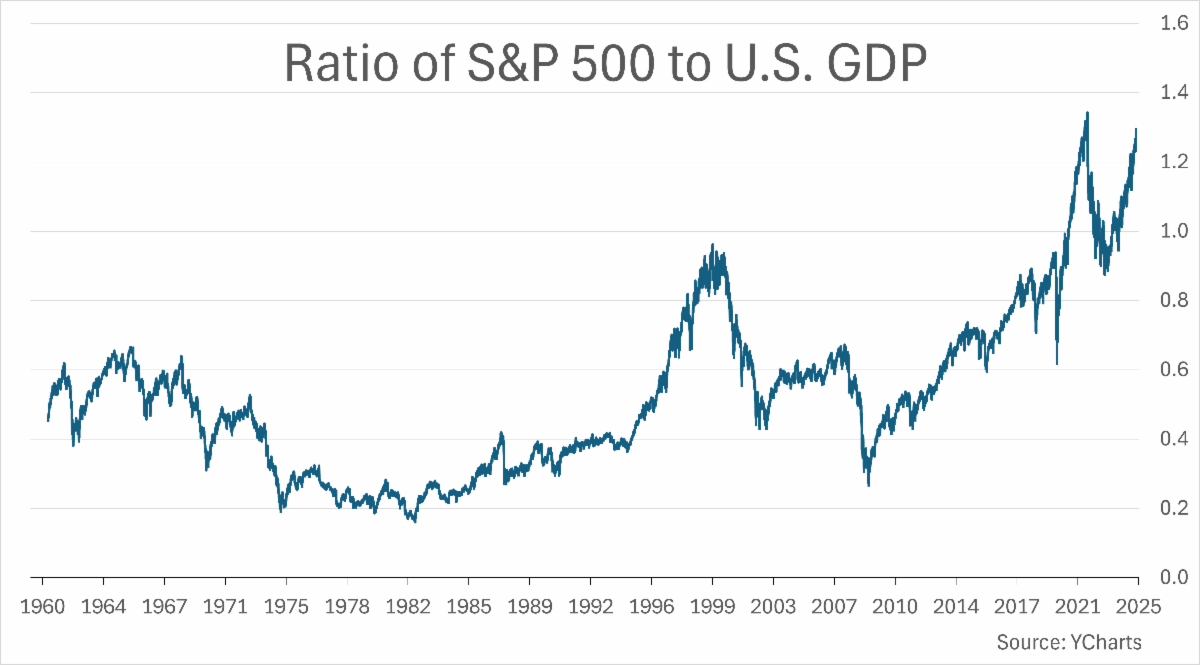

While he hasn’t been making specific statements about market valuations, we wonder if “The Buffett Indicator” has factored into his thinking. Popularized in 1999 after he wrote an article in Fortune Magazine, the Buffett Indicator is basically the ratio of the stock market to U.S. Gross Domestic Product (GDP).

Now at an extreme high, this ratio alone is clearly NOT the full picture in Buffett’s mind. Re-reading his 1999 article more closely, we see that he made four observations regarding each of two 17-year periods:

Buffett concluded that for the stock market to perform over the next 17 years (e.g., 1999-2016) like it had performed in the previous 17 years, interest rates would have to continue falling and corporate profits as a percentage of GDP would have to continue rising.

They did. And yet, because of the 2008 financial crisis:

Bottom Line – The Buffett Indicator isn’t as clear as it was in 1999. And so, there may be other reasons Buffett has reduced his Apple stock holding by 2/3rds. It’s more likely due to taxes and position size (concentration) than valuation.

A Roth conversion is a strategy to move money from a traditional IRA or 401(k) into a Roth IRA, where future growth and withdrawals are generally tax-free. The primary logic behind doing a Roth conversion revolves around paying taxes now instead of later, and it hinges on a few key considerations:

1. Required Minimum Distributions (RMDs): Traditional IRAs and 401(k)s require you to take RMDs starting at age 73 (in most cases), which increases taxable income in retirement. Roth IRAs have no RMDs, giving you more control over your retirement income and tax situation.

2. Anticipation of Higher Future Tax Rates: By converting now, you lock in your current tax rate, potentially saving money if (when) rates increase later.

3. Tax-Free Growth and Withdrawals: Roth IRAs allow for tax-free growth and withdrawals in retirement. Converting now means the growth will not be taxed when you need it.

4. Estate Planning Benefits: Roth IRAs can be advantageous for leaving an inheritance, as heirs can benefit from tax-free withdrawals over time. This can help pass on wealth efficiently.

5. Temporary Low Income or Losses: If you experience a temporary reduction in income or have significant deductions (like business losses or medical expenses), it might push you into a lower tax bracket. Converting in a low-income year can reduce the tax hit of the conversion.

6. Longer Investment Horizon: The longer your funds remain invested, the more they can grow tax-free in a Roth IRA. For younger investors, a conversion can maximize the benefit of this tax-free growth.

Deciding on whether a Roth conversion makes sense for you is just one many parts of our financial planning process. Everyone is different. We take your specific circumstances into account, run the numbers, and collaborate with you on an optimal amount to convert, if any. Please let us know if you have any questions about your situation and whether it might make sense for you.

In 2015, a study by professors of psychology at Brigham Young University concluded that social isolation and loneliness were associated with a higher risk of early death than obesity or physical inactivity. This research suggests that building strong, supportive relationships can be a powerful first step in improving both mental and physical health—even before tackling lifestyle factors like obesity or lack of exercise. Social connection plays a foundational role in overall well-being, often creating a positive feedback loop that can make other healthy behaviors easier to adopt and maintain.

“If all the economists were laid end to end, they’d never reach a conclusion.”

– George Bernard Shaw

Answer: A bank