We Are Currently Hiring!

Welcome to the latest edition of the Healy Wealth Management newsletter, your monthly guide to navigating the financial complexities of life.

Let us know your thoughts. And if there’s something that could benefit a friend or family member, please send it their way.

In this video, we delve into the sweet side of Halloween economics—chocolate! We’ll explore what chocolate is, the major players in the industry, and whether investing in chocolate could be a treat for your portfolio.

Please watch and share your thoughts and questions.

Poor people have it.

Rich people need it.

If you eat it, you die.

What is it?

As with any individual or institution, the financial position of governments is fully reflected by their assets, liabilities, income, and expenses. It’s pure math. When income exceeds expenses, assets rise. When expenses exceed income, assets fall. Whether or not you have liabilities is a function of your timing decisions.

For instance, homebuyers taking on a mortgage are making a timing decision. They believe they will have enough consistent income in the future to make the payments. When done prudently, this can be a manageable, and even wise, risk to take.

Governments are in a unique position. They can instantly enhance their financial position by printing money. This can be reflected in an increase in assets or income, or a decrease in liabilities.

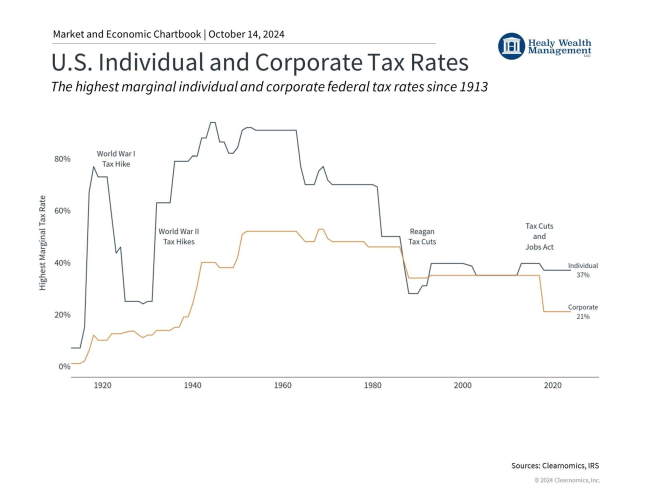

However, like any institution, a government represents a collection of interests. They cannot be viewed in a vacuum. Individual income taxes represent about 50% of US government income (revenue). Another 36% comes from payroll taxes intended to fund Social Security and Medicare. Corporate taxes contribute around 7-8% with the remaining 6-7% coming from excise taxes, estate taxes, customs duties, and other sources.

According to the Congressional Budget Office, the 2024 US Federal budget deficit is projected to be $1.9 trillion, or about 6.7% of GDP versus the historical average of 3.7%. So, to keep the deficit at the average level, tax rates must rise by 3.0%. This could be achieved by raising each individual tax bracket by 3%. Or, because most tax revenue is collected from those in the highest tax bracket, perhaps raising the rate on this single tax bracket from 37% to say, 43%, might do the trick.

What about Kamala’s proposed 28% capital gains tax? Would that do it? Stay tuned next month for our perspective.

Our very own Kathy Healy will be presenting at the Accounting and Financial Women’s Alliance “Women Who Count Conference” in Hilton Head, SC on October 25th. During her talk, she will be discussing “Wealth for Women: Strategies to Overcome Retirement Savings Gaps.”

In addition, on October 26th, Kathy will be participating in a panel discussion regarding “Beyond the Degree: Charting Diverse Career Paths in Business and Accounting.”

For many, texting has become a primary mode of communication. Here are twelve habits to keep for optimal outcomes:

Of course, don’t text and drive. But also, don’t put others in the situation of texting and driving. For instance, if someone replies “driving”, stop texting. Don’t even say “ok”.

Account View Unavailable Oct. 25-26, 2024 for Maintenance

You should experience improved performance, resiliency, and speed in Account View following the upgrade.

Client statements cannot be sent via email. Instead, clients can choose eDelivery in Account View 2.0.

Clients must have their own profile on Account View 2.0 in order to enable paperless options.

To select paperless through Account View 2.0:

1. After signing into Account View, select Paperless Status at the top of the page.

2. From there, you can choose to either go 100% paperless for all eligible documents, or pick and choose.

For information on requesting paperless settings for secondary clients in Account View, please reach out to Sandy Green for further instructions: sandy@healywealth.com.

“If you are not willing to learn, no one can help you.

If you are determined to learn, no one can stop you. “

-Zig Ziglar

Answer: Nothing