Welcome to the latest edition of the Healy Wealth Management newsletter, your monthly guide to navigating the financial complexities of life.

Let us know your thoughts. And if there’s something that could benefit a friend or family member, please send it their way.

Curious about the best time to start Social Security? In this video, Kathy Healy, Managing Partner of Healy Wealth Management, delves into how Social Security functions, explores how timing might depend on your current work situation, and highlights essential factors to consider as you near retirement.

At Healy Wealth Management, we know that financial planning isn’t one-size-fits-all, so we’re here to clear up myths and guide you toward a tailored financial strategy.

What can travel around the world while staying in a corner?

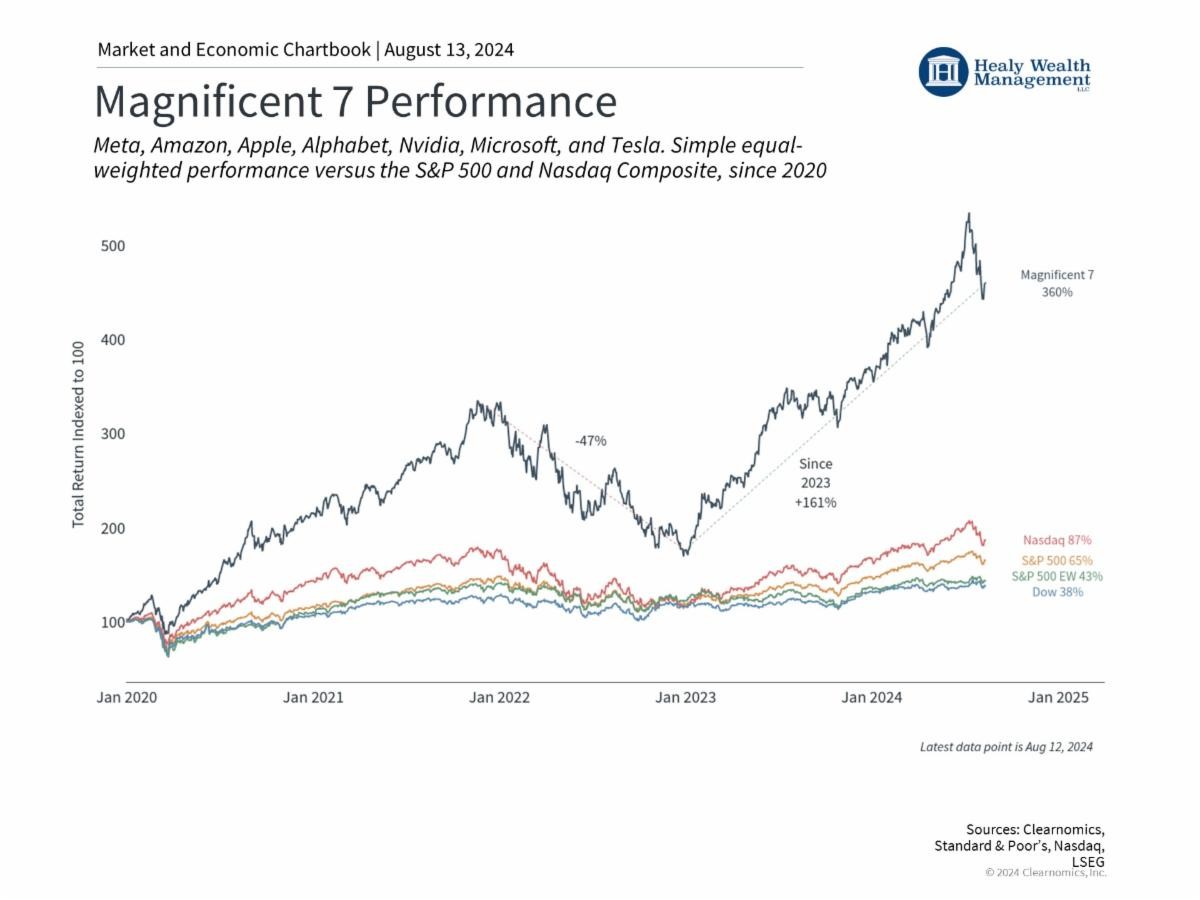

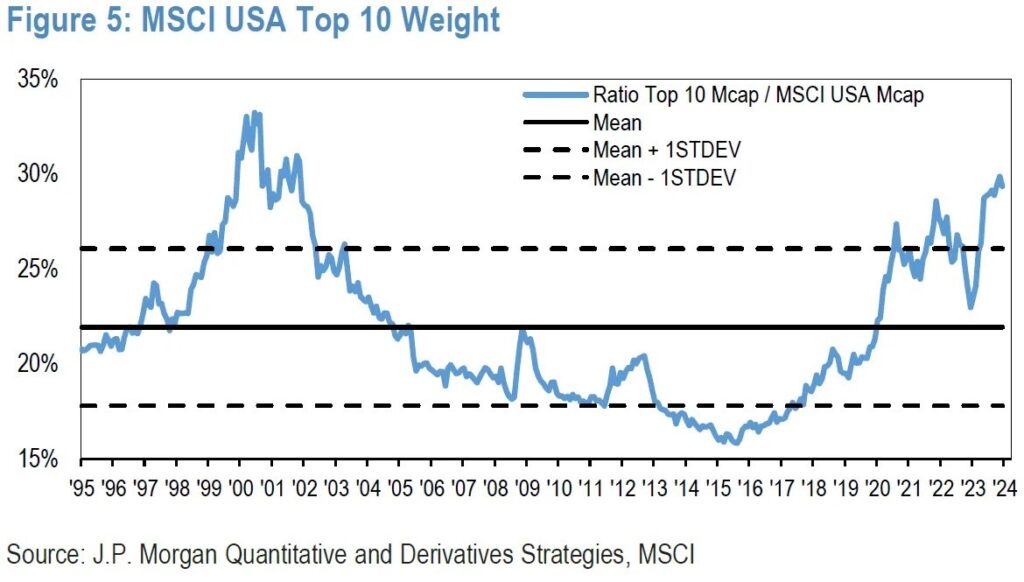

Due to big gains in recent years, a small group of seven companies in the S&P 500 index have become known on Wall Street as the Magnificent Seven (see list of names in the above chart). This year has been a dramatic tale of two markets, with this narrow group of stocks strongly leading the way – recent weeks notwithstanding. Now representing roughly one-third of the total U.S. stock market, and roughly 1.5x the European stock market, this concentration of seven stocks has elicited memories of the internet dot com bubble of the late 1990’s.

Similar to today’s market, in 1999, a very limited number of stocks were responsible for the majority of the gains (see chart below). In the bursting of the internet bubble, the stock prices of many non-internet-based businesses, across diverse sectors and industries, held up as the market declined from 2000 to 2003.

Remember, the stock market is like a supermarket. Instead of buying groceries, you’re buying businesses. And not everything is a good buy. We don’t pay much attention to the average price of everything (the index). Rather, as we go shopping, we ask whether each business (e.g., food item) is worth its price.

As of July 1, 2024, Georgia allows real estate to be transferred to beneficiaries through a transfer-on-death (TOD) deed, also known as a beneficiary deed. This new law, which was passed during the 2024 legislative session, allows property owners to designate a beneficiary who will automatically inherit the property after the owner’s death, avoiding probate. The law includes a deed form that can be recorded by the record owner, who can then designate one or more beneficiaries.

How might this effect you and your family? There are pros and cons to consider, depending on your particular circumstances. We can help you decide if it makes sense to talk to your attorney.

“Attitude is more important

than the past,

than education,

than money,

than circumstances,

than what people do or say (…)

than appearance,

giftedness,

or skill.”

-W.C. Fields

Answer: A stamp

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through IFG Advisory, LLC, a registered investment advisor. IFG Advisory, LLC, Healy Wealth Management, and Integrated Financial Group are separate entities from LPL Financial. The LPL Financial registered representatives associated with this page may only discuss and/or transact business with residents of the following states: AL, CA, DC, GA, KY, MD, MO, NJ, PA, SC, TX, and WA.